If you are a freelancer, run your own small business, or are not employed by any company, then you have to get your own health insurance. This may seem a little difficult, but taking responsibility for your own health is actually a very smart thing to do. Today we will tell you why health insurance is important for self-employed people living in the USA and how to choose it.

What is Health Insurance?

Health insurance is a plan that helps you with money in case of illness, accident, or any health emergency. With its help, you can cover the cost of doctor’s fees, hospital bills, surgery, and medicines.

Being self-employed, you do not get this facility from the company, so you have to get it yourself.

Why do Self-Employed people need Health Insurance?

- Emergency Protection: Sickness or accident can happen at any time. Insurance makes treatment easy and saves from worry.

- High Doctor/Hospital Expenses: In USA doctor’s fees and hospital bills are very expensive. Insurance makes them manageable.

- Cover your family too: You can cover your wife, children or parents along with yourself.

- Peace of mind: While working there is a hope that any major health expense will be covered.

Which insurance options are there for you (in the USA)?

- Marketplace Plans (Obamacare/ACA): These are government-approved plans (available at

Healthcare.gov). You may get a subsidy (financial help) based on your earnings, which reduces the premium. - Private Company Plans: Companies like BlueCross, Aetna, UnitedHealthcare have their own plans. These can be a little expensive but offer more flexibility and choices.

- Health Sharing Programs: These are mutual sharing through groups (religious or social). Their monthly cost is low, but not everything is covered and the rules are strict.

- COBRA Plan (If you were in previous job): If you have just left your job, you can continue your old company’s plan for some time through COBRA (this is a temporary and expensive option).

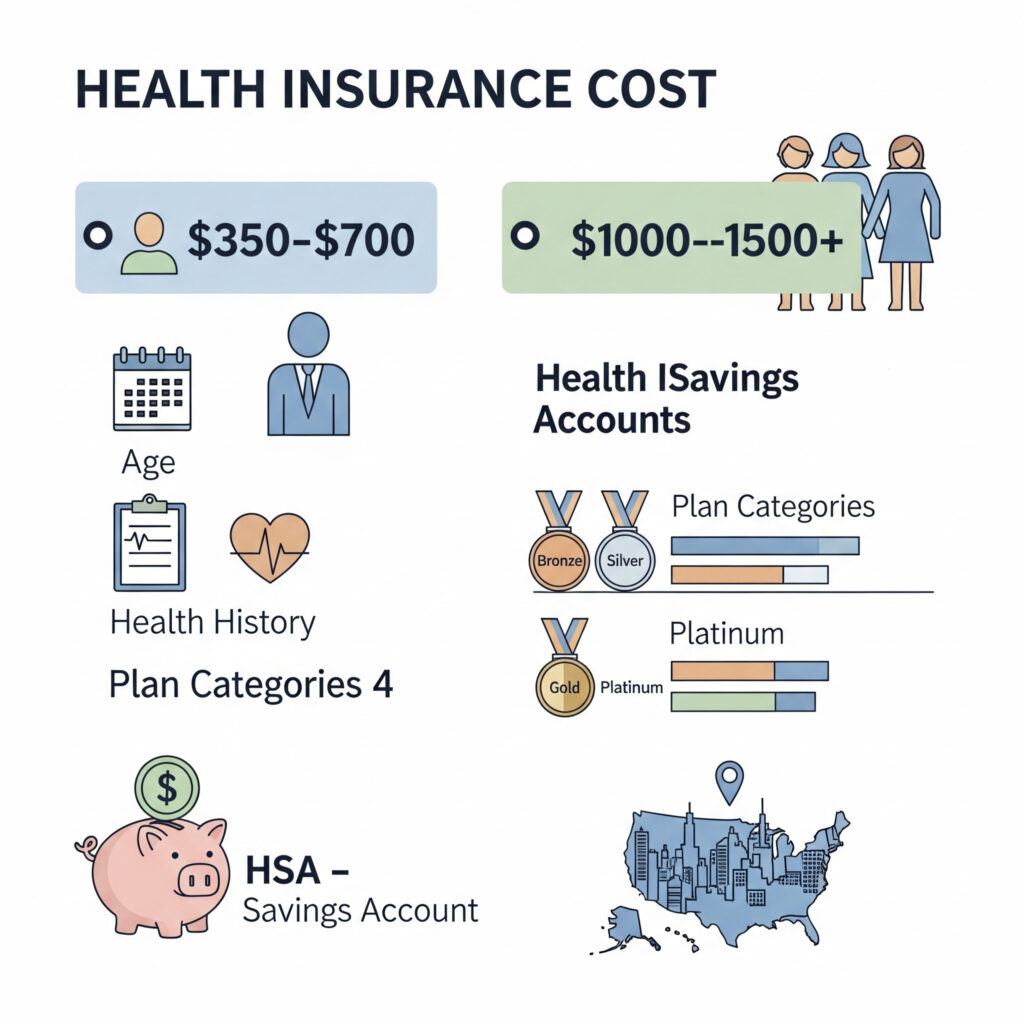

How much does it cost in USA?

The monthly premium (QIST) of insurance depends on these things:

- Your age

- Your health history

- Plan category (Bronze, Silver, Gold, Platinum)

- Your residence area (state/city)

- Expectation:

- Single Person: $350 – $700 per month

- Family (e.g., 4 people): $1000 – $1500+ per month

Some people also create Health Savings Account (HSA). This is a tax-free account where you can save money and use it for future health expenses.

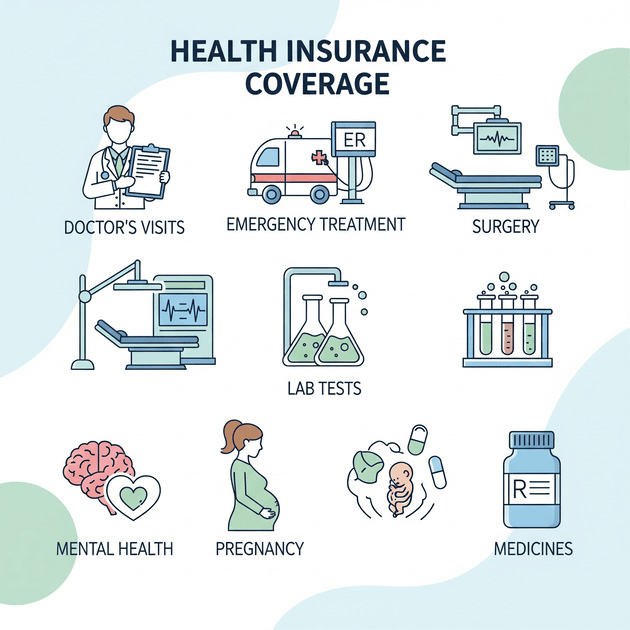

What all is covered in general?

- Doctor’s visits

- Emergency room treatment

- Surgery

- Lab tests

- Mental health care (mindfulness)

- Pregnancy and delivery expenses (pregnancy/maternity)

- Medicines prescribed by the doctor (prescriptions)

What is not covered in general?

- Cosmetic surgery (which is not necessary for health)

- Pre-existing diseases (pre-existing conditions) – These are covered in ACA plans

- Treatment of teeth and eyes (dental/vision) – a separate plan is required

- Alternative treatments like massage or acupuncture (can be included in ACA plans)

How to choose a better plan for USA?

- Look at your monthly income and expenses.

- Understand the number of people in the household and their health needs.

- Compare Bronze, Silver, Gold plans (higher premium = less out-of-pocket when sick).

- Check the list of network hospitals and clinics (are your favorite doctors included?).

- Check the deductible (how much you will have to pay in advance) and whether the out-of-pocket limit is within your budget or not.

- Check the eligibility for subsidy (aid) on

Healthcare.gov.

Tax benefit too!

In the USA, self-employed people can deduct their health insurance premium from their federal tax. This means that your taxable income is reduced and you pay less tax.

Conclusion:

Nowadays when health expenses are increasing so rapidly, taking health insurance for self-employed people has become not just a wisdom but a dire necessity. This is not just your health but also the need of your family members