In today’s time of inflation, everyone needs extra money at some point or the other. Be it home repairs, children’s fees, or any emergency. If you have your own house, you can take advantage of the value of that house and take a “Home Equity Loan”. Let’s understand what this loan is and how it works.

What is a Home Equity Loan?

When you buy your home and live in it for some time, you create some “equity” in that home. Equity means: Total market value of the home minus The amount that you have not yet been able to pay in the mortgage loan.

- For example:

- If the market value of your home is $300,000.

- And you have only paid $200,000 in mortgage loan so far.

- So you have equity of $100,000.

- You can take some part of this equity (e.g. $50,000 or $75,000) as a new loan. This new loan is called Home Equity Loan.

How does a Home Equity Loan work?

- You apply through a bank, credit union, or online lender.

- The lender decides the amount of loan it can give you based on the current market value of your home (through appraisal), your income, and your credit score.

- If the loan is approved, you get a fixed amount (say $50,000) in one go.

- You can use this money for any important work – building/demolishing a home, financial expenses, savings, or any other emergency.

- Every month you have to pay a fixed installment of this loan. You have to repay this installment in a time period ranging from 5 years to 30 years.

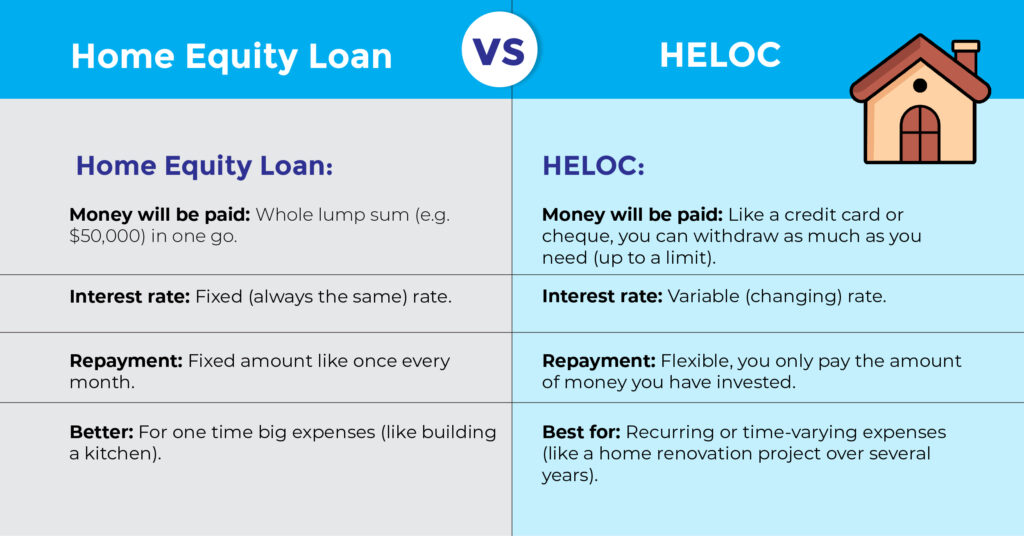

Difference between HELOC and Home Equity Loan

People often confuse Home Equity Loan and HELOC (Home Equity Line of Credit). Let’s understand the difference between the two in simple words:

- Home Equity Loan:

- Money will be paid: Whole lump sum (e.g. $50,000) in one go.

- Interest rate: Fixed (always the same) rate.

- Repayment: Fixed amount like once every month.

- Better: For one time big expenses (like building a kitchen).

- HELOC:

- Money will be paid: Like a credit card or cheque, you can withdraw as much as you need (up to a limit).

- Interest rate: Variable (changing) rate.

- Repayment: Flexible, you only pay the amount of money you have invested.

- Best for: Recurring or time-varying expenses (like a home renovation project over several years).

Home Equity Loan is good for whom?

- Building a house or repairing it

- Paying off high-interest debts like credit card or personal loan and combining them into a low-interest loan (Debt Consolidation)

- Time expenses (college fees etc.)

- Illness bills (Medical bills)

- Creating an emergency fund

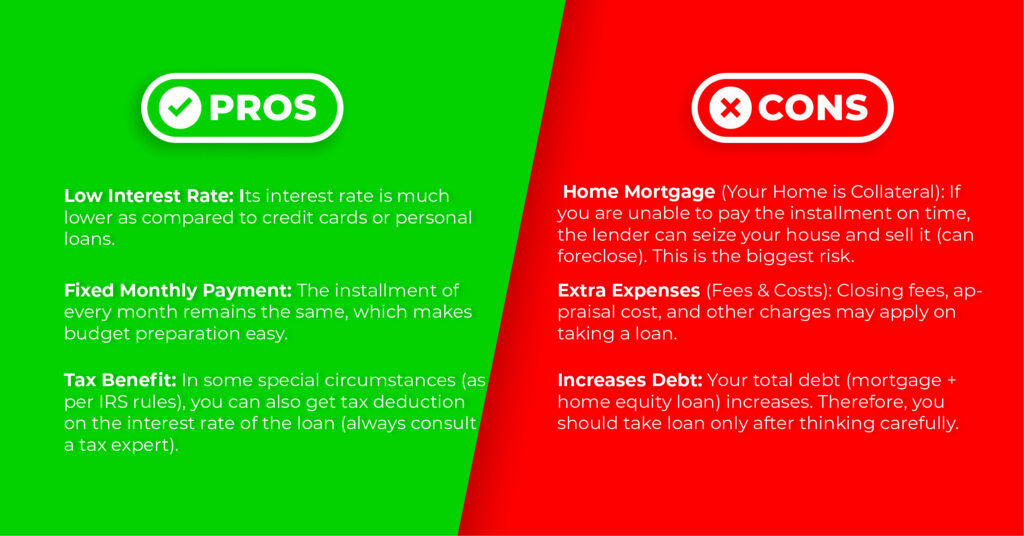

Home Equity Loan Benefits (Pros)

Home Equity Loan Benefits (Pros)

- Low Interest Rate: Its interest rate is much lower as compared to credit cards or personal loans.

- Fixed Monthly Payment: The installment of every month remains the same, which makes budget preparation easy.

- Tax Benefit: In some special circumstances (as per IRS rules), you can also get tax deduction on the interest rate of the loan (always consult a tax expert).

Cons of Home Equity Loan

- Home Mortgage (Your Home is Collateral): If you are unable to pay the installment on time, the lender can seize your house and sell it (can foreclose). This is the biggest risk.

- Extra Expenses (Fees & Costs): Closing fees, appraisal cost, and other charges may apply on taking a loan.

- Increases Debt: Your total debt (mortgage + home equity loan) increases. Therefore, you should take loan only after thinking carefully.

Who should take this loan?

If you:

- Are a home owner and have built up good equity in it (e.g. more than 15-20%).

- Want to spend a large amount at one time (e.g. a project).

- Your income is stable and fixed.

- Can pay at regular intervals every month.

…then Home Equity Loan can be a good option for you.

Keep these things in mind before taking a loan:

- Check your credit score. A better score = a better interest rate.

- Compare rates and terms from several different lenders (banks, credit unions).

- Read and understand all the conditions and terms of the loan carefully.

- Take only as much loan as you actually need. Don’t be tempted to take more.

Conclusion:

Home Equity Loan is a powerful financial tool. But like any such weapon, it is important to use it wisely and responsibly. If you have equity in your home, use it wisely. A wrong decision can put your home at risk.

(Note: Tax benefits depend on IRS rules and your specific situation. Always consult a qualified tax advisor. The information on EasyStackLoans.com is provided for your convenience and appreciation. Do your own research and understand the terms and conditions before entering into an agreement with any lender.)