In the USA, House value has increased by 45% (2020-2025). If you have $100,000+ equity in your home, you can awaken your “slack money” through cash-out refinance!

What is Cash-Out Refinance?

- Old Loan Exchange: Pay off existing mortgage with new loan

- Equity Withdrawal: Take cash from remaining value of house

- Example:

House value: $500,000

Remaining Mortgage: $200,000

Can withdraw: $150,000 cash (up to 80% LTV)

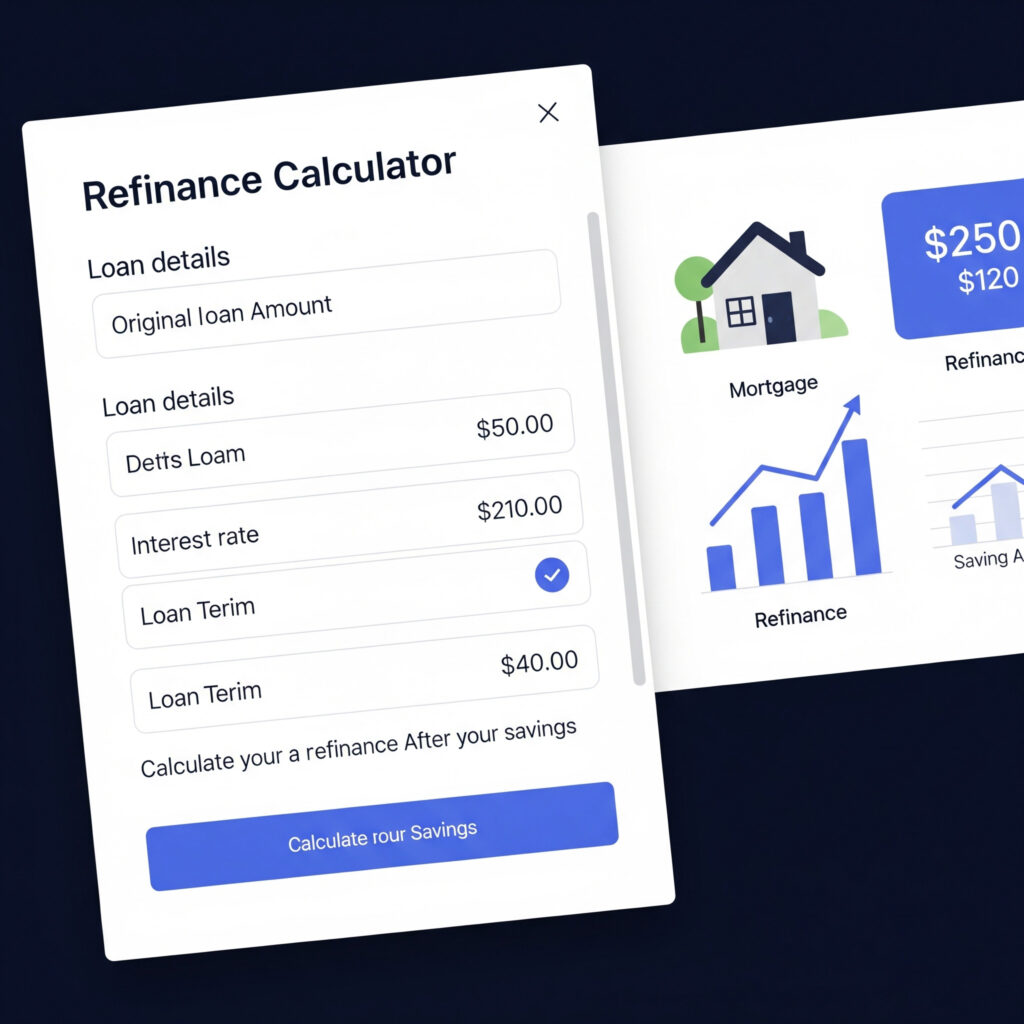

How does Refinance Calculator work? 3 Steps to Start:

- Enter your data:

- House price: $450,000

- Remaining loan amount: $180,000

- Cash demand: $100,000

- New loan interest: 6.5%

- Calculator:

- New loan amount: $280,000 ($180k old + $100k cash)

- Monthly loan amount: $1,770 (30 years)

- Closing interest rate: $8,400 (3%)

- Loan-to-Value (LTV):

($280,000 / $450,000) × 100 = 62% (Safe!)

(Try: Bankrate.com or Zillow Refi Calculator)

4 Benefits (US Context):

- Debt Consolidation:

Credit card interest (24% APR) → 6.5% APR = $10,000/year savings - Home Renovation:

Kitchen upgrade ($50,000) can reduce home cost by $75,000 - Children’s Income:

College fees ($30,000/year) can be easily managed - Do Good Work:

Old loan was 8%? Now 6.5% = $200/month savings

When is it right? (US Rules)

| Situation | Cash-Out Refi Suitable? |

|---|---|

| Credit Score 680+ | Yes |

| LTV < 80% | Yes |

| 5+ Years Remaining | Yes |

| Interest Rates Falling | Yes |

| Credit Score < 620 | No |

| Plan Shift City in 2 Year | No |

Better Alternatives:

- HELOC:

Line of credit from equity (use only as much as you want) - Personal Loan:

Up to $50,000 @ 8% APR (credit score 700+) - Cash-Out ARM:

If the loan amount is low (first 5 yr 4.5%)

Real US Example:

Ahmed & Ayesha (California):

- House price: $750,000

- Bank loan: $250,000

- Cash out: $200,000

- Istemal:

✓ Medical debt payoff: $50,000

✓ Solar panels: $40,000

✓ Daughter’s wedding: $60,000 - Monthly amount: $2,100 → $3,800 (24% credit card debt eliminated!)

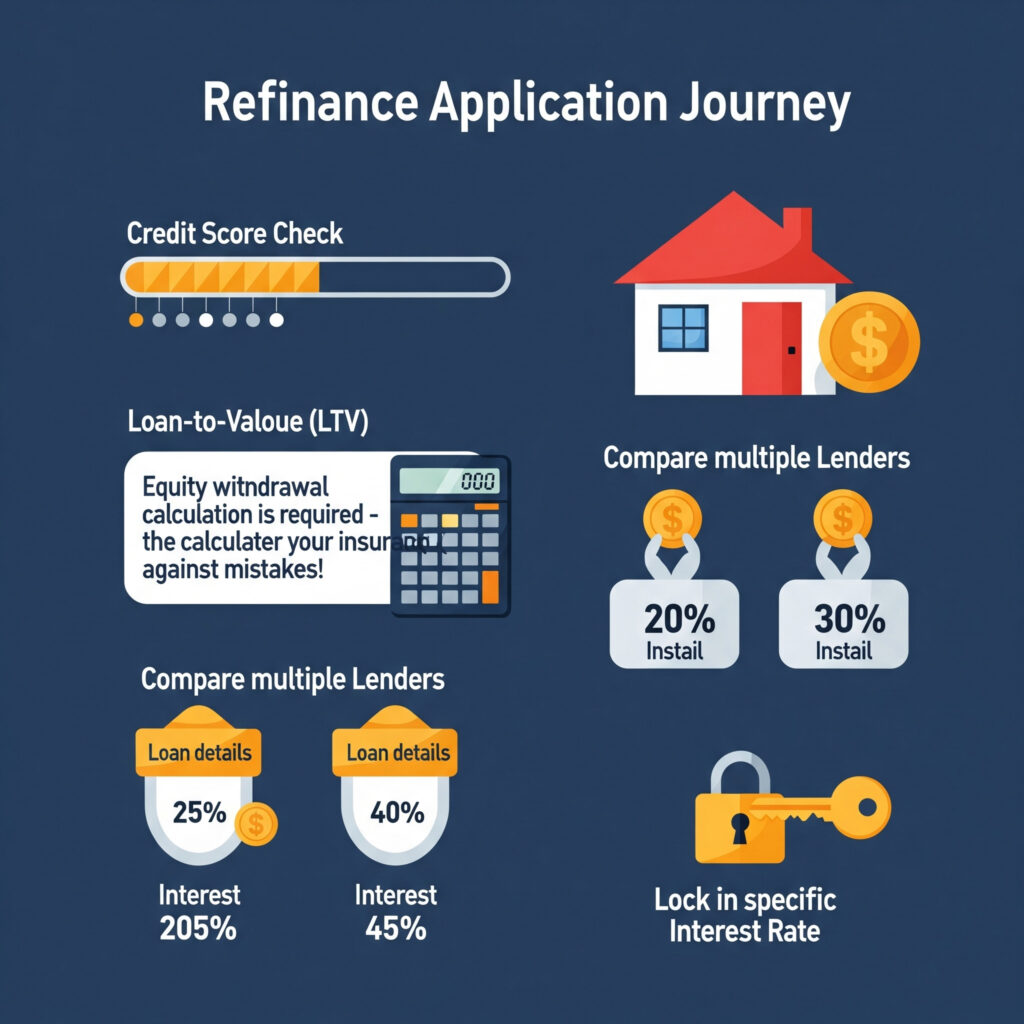

How to Apply:

- Credit Score Check:

Check it for free on CreditKarma.com (680+ required) - Calculate LTV:

(Existing loan + Cash needed) / Home value < 80% - Compare Lenders:

Rocket Mortgage, Better.com, Local credit unions - Lock Rate:

Fix the rate before paying the loan amount

“Equity withdrawal calculation is required – the calculator is your insurance against mistakes!”

Conclusion:

Cash-out refinance is America’s #1 equity access scheme, let’s ask 3 questions:

1) What is the new amount in the budget?

2) How will I pay the closing costs?

3) Will this money give 2x return in 5 years?

(For free consultation call HUD Housing Counselor (800-569-4287))