Introduction

Auto insurance is an agreement that gives you financial protection if your car is damaged in an accident, theft, or for any other reason. Choosing a good insurance company is very important because it affects your claims, premium rates, and overall experience. In this article, we will talk about auto insurance companies in detail so that you can make a better decision.

1. What Is an Auto Insurance Company?

An auto insurance company is a business that provides financial coverage to car owners. If you have an accident, your car is damaged or someone is hurt, this company will cover your loss. It is mandatory to take insurance at all times, otherwise you may face legal or criminal problems.

Insurance companies are controlled by the government, so they have to abide by the law. You should choose the right policy according to your car.

2. Types of Auto Insurance Coverage Offered

Insurance companies offer coverage of different terms:

- Responsibility Insurance (Liability): This is mandatory – if you are at fault in an accident, this will cover the loss of the other driver.

- Collision Coverage (Collision): If your car is damaged in an accident, this will bear the cost of repairs.

- Complete Coverage (Comprehensive): This is for non-traffic matters like theft, fire, destruction (natural disasters).

- Personal Injury Coverage (PIP): The medical bills of you or the passengers will be covered in an accident. – Be-Insurance Driver Coverage: If the other driver is not insured, this will protect you.

Extra benefits include roadside help, rental vehicle coverage, and gap insurance.

3. How Auto Insurance Companies Work

- Premium: This is the monthly/yearly payment you make to the company.

- Deductible: The amount you have to pay before making a claim (for example Rs. 10,000).

- Method of Claims: If there is an accident, inform the company, it would be correct and then you will get the payment.

- Discounts: Safe drivers, students, and those who take multiple policies get a discount.

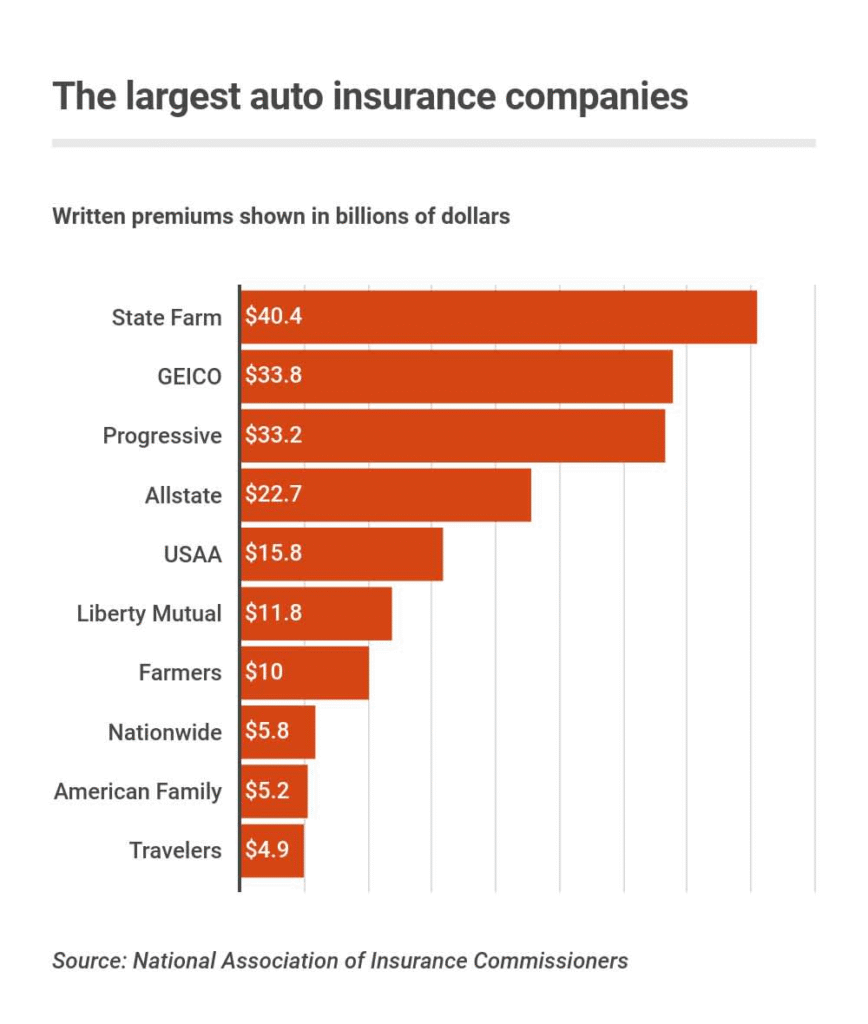

4. Top Auto Insurance Companies in 2024 (Comparison)

Some top companies that offer good quality:

- State Farm: Trustworthy, good customer service.

- Geico: Cheap, online-friendly.

- Progressive: Custom-made plans.

- Allstate: Local agents help.

- USAA: Best for military fraud.

Compare them with customer reviews, price and way to settle a claim.

5. How to Choose the Best Auto Insurance Company

- Check the coverage: It is better to take more than the legally required.

- Compare the questions: Ask for quotes from 3-4 companies.

- Read the reviews: See people’s experiences (Google, Facebook).

- Claim process: Which company makes quick payment?

- Check the quotes: No-claim bonus, safe driver discount etc.

6. Common Mistakes When Choosing an Auto Insurance Company

- Only look at the latest policy, do not check the coverage.

- Do not compare multiple quotes.

- Do not read details of the policy (hidden specifications, exceptions).

- Do not update the policy after any change in life (new car, change of city).

7. Emerging Trends in Auto Insurance (2024 & Beyond)

- Pay-Per-Mile Insurance: Do you drive less? Pay less premium.

- AI Claims: Now send pictures, AI will check the damage.

- Self-driven vehicles: Insurance rules will change in due course.

8. Frequently Asked Questions (FAQs)

S1: How to reduce insurance premium?

- Drive safe, reduce deductible, go to the doctor.

S2: What to do after an accident?

- Call the police, take pictures, inform the company.

S3: Does credit score affect premium?

- Yes, many companies look at this.

S4: Can the policy be changed in between?

- Yes, but cancellation charges may apply.

Conclusion

It is important to get auto insurance, but choosing the right company is equally important. Compare, see reviews and choose the policy as per your needs.

Last Tip: Take quotes from at least 3 companies and then finally decide!